How to Calculate CapEx Capital Expenditure: Formula & Examples

- admin

- August 31, 2021

- Bookkeeping

- 0 Comments

Capital expenditure purchases are most often used to fuel development and growth for the company. Examples include the construction of new facilities, maintenance, and expansion of existing facilities, and the purchase or upgrade of technology. Effective Capex planning ensures that businesses allocate resources wisely and make informed investment decisions.

Cash Flow From Financing Activities: Definition, Formula & Examples

- However, the decision to start a project involving much capital expenditure must be carefully analyzed as it will have a significant impact on the financial position and cash flow of a company.

- Moreover, technological advancements and market volatility make it trickier to invest in such expenses as the return on such huge investments becomes all the more uncertain.

- Depreciation can be misleading by itself; you aren’t entirely sure whatis included in this line item, which could lead you to an unrealistically highnumber for maintenance CapEx calculations.

- They reflect a company’s forward-thinking approach and its dedication to sustained growth.

- The first company we will work on is Oshkosh Corp; I will lay out the formulas to use and where we can locate the info so you can follow along.

- Plus, you can see areas of your business where you can improve and even cut costs.

This is since they aren’t going to appear on your income statement, but can have a positive impact on cash flow. This allows you to invest in things such as new technology for your business or another type of asset that can contribute to business growth. CapEx can be incredibly important if you want to grow and maintain business operations.

Property, Plant and Equipment

One of the best modern examples of this situation is data storage and networking. Operating expenditure, also known as “OpEx” or Operating Expense, are those expenses necessary for daily business operations, generally including anything with a useful life of less than a year. Broadly speaking, this includes expenses relating to buying, updating, repairing, or improving a “non-current asset” (aka “fixed asset”). Back then, expenses that related to the day-to-day operations of the business were dubbed “Revenue Expenditure”. When ABC records the machine repair on the books, it debits an expense account and credits cash.

Capital Expenditures FAQs

In conclusion, Capital Expenditures are a fundamental aspect of financial management. They reflect a company’s forward-thinking approach and its dedication to sustained growth. By understanding CapEx and its calculation, investors and analysts can better evaluate a company’s financial health and its potential for long-term success in the ever-evolving world of finance.

How confident are you in your long term financial plan?

Here are some of the secrets that will ensure the budgeting of capital expenditures is efficient. The range of current production or manufacturing activities is mainly a result of past capital expenditures. Similarly, the current decisions on capital expenditures will have a major influence on the future activities of the company.

What is the Capital Expenditure Formula?

So, for example, if a company buys a $5,000 piece of equipment it intends to use for five years and capitalizes the cost over that five-year lifetime, the annual depreciation would be $1,000. Additionally, accountants, business owners, and a company’s financial team should all be familiar with capital expenditures for budgeting purposes. For example, the entire team needs to know how much money can be invested in new PP&E and if any existing PP&E should be sold to fund other ventures. A company’s financial team should also know how to use CapEx strategically to benefit the company in the long run. So, capital expenditures are investments into these long-term assets with a “useful life” of more than one taxable year. By U.S. Internal Revenue Service (IRS) standards, investments into assets with a useful life exceeding one year need to be capitalized.

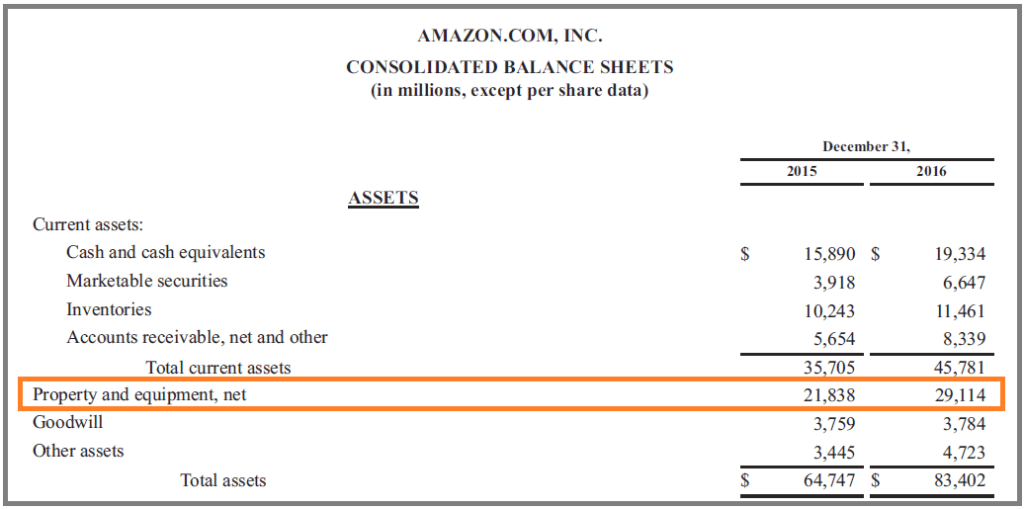

CapEx (short for capital expenditures) is the money invested by a company in acquiring, maintaining, or improving fixed assets such as property, buildings, factories, equipment, and technology. CapEx is included in the cash flow statement section of a company’s three financial statements, but it can also be derived from the income statement and balance sheet in most cases. A company’s cash flow statement details capital expenditures in the investing cash flow section, showing cash outflows to fixed assets and inflows from selling them. The current PP&E is the value of the property, plant, and equipment listed on a company’s financial statements. Current means using the value for the accounting period you want to find the total CapEx for. For example, if you are looking for a company’s total capital expenditures for 2022, you’d use the 2022 total value of PP&E from a company’s balance sheet.

These types of expenses are reported on the income statement, and they reduce the company’s profit for the year. There’s no real calculations needed if you have access to your company’s cash flow statement. And they would get included in the investing cash flow section of the cash flow statement. This calculation provides a clear picture of the financial resources allocated to enhancing a company’s operational capacity, efficiency, and growth potential. Capital expenditures represent the portion of a company’s cash flow that is dedicated to building, upgrading, or maintaining tangible assets, which are essential for long-term success. The cash flow to capital expenditures ratio measures the ability of a company to purchase capital assets using the cash generated from its operations.

Operating expenses (OpEx) are costs incurred in day-to-day operations, while CapEx represents long-term asset investments. In other words, capital expenditures are considered sunk costs, and businesses have to “sink or swim” with their decisions. This indicates that for every $2 dollars of cash gained through its business operations, the company has how to find capex previously allotted around $1 dollar for capital expenditures. Major capital projects involving huge amounts of capital expenditures can get out of control quite easily if mishandled and end up costing an organization a lot of money. However, with effective planning, the right tools, and good project management, that doesn’t have to be the case.

When a company capitalizes an asset, it spreads the cost over its expected useful life, reflecting the gradual wear and tear. This depreciation expense is recorded on the income statement and reduces the asset’s value on the balance sheet over time. It mirrors the asset’s loss in value as it ages, aligning with accounting principles and providing a more accurate representation of a company’s financial performance.

Another way to think of Capital Expenditure is that a company is buying something for the specific purpose of increasing its capital generation capabilities. Investors like to see consistent growth in a company, and you are probably seeking better ways to figure out which companies are achieving this growth. Capital Expenditure (aka CapEx) is an important figure to accountants, investors, entrepreneurs, and financiers alike.